ConstructionScarsdale, New York

ConstructionScarsdale, New York Repeat borrower of PBC sought acquisition and construction financing for a new ground-up construction for a single-family residence in Scarsdale, New York. PBC provided both the acquisition and construction financing for the transaction.

Fix & FlipNew Rochelle, New York

Fix & FlipNew Rochelle, New York New Borrower with PBC is purchasing this property to convert into a two-family residence. Borrower sought acquisition and rehabilitation financing and PBC funded the entire capital stack.

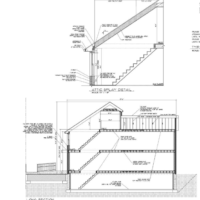

ConstructionCroton-on-Hudson, NY

ConstructionCroton-on-Hudson, NY Borrower known to PBC sought 100% construction costs for a ground-up build. PBC funded the request with the first draw disbursed at closing.

New ConstructionSt. Petersburg, Florida

New ConstructionSt. Petersburg, Florida New borrower to PBC seeking construction financing for a single-family residence in St. Petersburg, Florida. Borrower is a highly experienced builder making entry into the greater Tampa Bay market. PBC funded the requested construction funds.

Fix and FlipNewtown, Connecticut

Fix and FlipNewtown, Connecticut Repeat borrower sought acquisition and rehabilitation (fix and flip) financing for a bank REO. PBC funded the the full capital stack and included an interest reserve.

Fix and FlipStaten Island , New York

Fix and FlipStaten Island , New York Borrower sought financing for the acquisition of an existing SFR and the construction of a new SFR on the same property. PBC financed the entire capital stack.

Fix and FlipOssining, New York

Fix and FlipOssining, New York Repeat borrower of PBC’s sought financing ti complete a subdivision and completion of new SFR.

RefinanceLoch Sheldrake, New York

RefinanceLoch Sheldrake, New York PBC was approached to refinance on a property having a challenging scenario. PBC utilized creativity, industry connections and teamwork to accomplish the borrower’s goals.

Cash-Out RefiMt. Vernon, New York

Cash-Out RefiMt. Vernon, New York Borrower is an owner of a warehouse/light industrial building in Mt. Vernon and required a cash-out refinance for business capex. PBC funded the request and provided a 24 month term without an pre-payment penalty.

Acquisition Port Chester , New York

Acquisition Port Chester , New York Repeat borrower’s of PBC sought acquisition funds for a private real estate sale. PBC funded the request and closed the deal in an expeditious fashion.

Cash-Out RefiNew Rochelle, New York

Cash-Out RefiNew Rochelle, New York Borrower sought quick financing for a cash-out refinance to fund additional investments, PBC satisfied the request.

C/O RefinanceBronx, New York

C/O RefinanceBronx, New York Owner of a multi-family property requested a cash-out refinance, PBC made a two-year term loan.

C/O RefinanceNew Rochelle, New York

C/O RefinanceNew Rochelle, New York Borrower sought a cash-out refinance and PBC closed the deal in a expedited fashion.

C/O Refinance Ridgefield, CT

C/O Refinance Ridgefield, CT Borrower sought a cash-out refinance for a to be completed renovation, PBC funded the request.

Construction Rye Brook , New York

Construction Rye Brook , New York Borrower known to PBC required financing to complete a new construction project. PBC was able to provide capital for mobilization of trades and additional capital for the final completion of the project.

AcquisitionSouthbury, CT

AcquisitionSouthbury, CT Borrower sought an acquisition loan with the flexibility of simultaneously refinancing another property. PBC was the direct lender and provided capital for both transactions within a very short time period to satisfy the strict timelines.

RefinanceBethel, CT

RefinanceBethel, CT Borrower sought an acquisition loan with the flexibility of simultaneously refinancing another property. PBC was the direct lender and provided capital for both transactions within a very short time period to satisfy the strict timelines.

Fix and FlipBurlington, North Carolina

Fix and FlipBurlington, North Carolina Repeat borrower sought a fix and flip loan for a new acquisition and rehabilitation of a three-family residence. PBC fulfilled the entire capital stack and, along with all of the portfolio loans, will service directly.

AcquisitionScarsdale, New York

AcquisitionScarsdale, New York PBC was engaged to provide acquisition bridge financing for a property that needed to close very quickly due to a Time of the Essence letter. PBC provided the necessary capital and closed within eight (8) days of being contacted.

RefinanceScarsdale, New York

RefinanceScarsdale, New York Borrower sought a quick closing to settle outstanding matters with a complex ownership structure. PBC was able to act as the direct lender and closed within 14 days.

ConstructionBronx, New York

ConstructionBronx, New York Repeat borrower sought the acquisition of a SFR to raze and construct a new two-family residence. PBC funded the entire capital stack.

Acquisition Rye Brook, New York

Acquisition Rye Brook, New York Borrower was seeking quick and flexible financing for a simultaneous refinance and acquisition transactions. PBC funded the transactions.

Acquisition/RenovationTenafly, NJ

Acquisition/RenovationTenafly, NJ Investor sought an acquisition and renovation loan and PBC, as the direct lender, provided the entire capital stack. The investor acquired the property and is renovating/expanding the premises.

RefinanceWest Harrison, New York

RefinanceWest Harrison, New York PBC acted as the direct lender for a refinance of a multi-family property in the Silver Lake area of Harrison.

AcquisitionNew Rochelle, New York

AcquisitionNew Rochelle, New York PBC was engaged to provide acquisition financing for an investment property. Deal was closed within 10 days.

ConstructionBronx, New York

ConstructionBronx, New York Repeat borrower, and full time real estate investor and developer, needed acquisition and construction financing for the development of a two-family house. PBC capitalized the loan with an 18 month term.

RefinanceBronx, New York

RefinanceBronx, New York Borrower required funds to satisfy RET and other debt, PBC moved quickly in order for short-term deadlines to be met. PBC extended a 24 month term loan.

AcquisitionHaverstraw, New York

AcquisitionHaverstraw, New York Local business seeks to relocate to new building with need of renovations. PBC provide the necessary capital to quickly secure and close the deal.

AcquisitionLittle Island Beach, New Jersey

AcquisitionLittle Island Beach, New Jersey Borrower attempted to fund conventionally but was denied since the home was located on its own island. PBC brought creative ideas to solve the conventional bank’s concerns.

AcquisitionNew Rochelle, New York

AcquisitionNew Rochelle, New York Borrower needed max money to buy-out partner in a timely fashion. PBC reacted quickly and funded the deal as requested.

Acquisition Cortland Manor, New York

Acquisition Cortland Manor, New York Borrower sought to purchase out the partnership of an investment property. PBC provided the capital to achieve that goal along with renovation funding.

Fix and FlipNewark, New Jersey

Fix and FlipNewark, New Jersey Repeat borrower of PBC’s, sought a fix and flip loan for a three family investment property. PBC funded both the acquisition and renovation of the capital sought.

Acquisition New Rochelle, New York

Acquisition New Rochelle, New York PBC provided the acquisition financing for an investment property that had a very short timeframe to close.

Acquisition Somers, New York

Acquisition Somers, New York Investor seeking capital to purchase a REO from an institutional investor with title complexities. PBC sorted out the issues and took the appropriate measures to safeguard the new owner’s and PBC’s positions, respectively.

RefianceNew Windsor, New York

RefianceNew Windsor, New York Investor required funds to complete a spec house, PBC refinanced the existing mortgage and provided the additional capital that the developer required to complete the project.

Acquisition New Rochelle, New York

Acquisition New Rochelle, New York Local investor needed to secure financing quickly to acquire a highly sought after property, PBC was there and structured financing that help facilitate the purchase.

RefinanceCongers, New York

RefinanceCongers, New York Repeat borrower of PBC’s sought an investment loan refinance. The situation presented many complexities and were worked-out under PBC’s leadership.

Acquisition Tuckahoe, NY

Acquisition Tuckahoe, NY Borrower introduced to PBC required quick acquisition financing for a two-family investment property. PBC provided 75% LTV within a two-week time frame to close the deal.

RefinanceAtlantic Beach, New York

RefinanceAtlantic Beach, New York Repeat borrower seeking capital to improve an investment property, PBC provided 100% of the amount requested.

Fix & FlipFar Rockaway, New York

Fix & FlipFar Rockaway, New York Longtime borrower of PBC sought 90% LTV financing with 100% of the rehabilitation costs financed. PBC was able to fund the request and close the deal within 10 days.

Acquisition Ossining, NY

Acquisition Ossining, NY First time borrower with PBC sought to acquire a SFR investment property as a long-term rental. PBC provided a two-year term mortgage.

Fix & FlipWest Hempstead, NY

Fix & FlipWest Hempstead, NY Repeat PBC borrower acquiring a SFR to rehab and requested the acquisition and rehab financing. PBC financed 90% of the acquisition and 100% of the rehabilitation costs.

RefinanceNew Rochelle, NY

RefinanceNew Rochelle, NY Owner of an investment three-family property was seeking a refinance. PBC provided a 30 year fixed mortgage on the property with no documentation required.

ConstructionWest Harrison, NY

ConstructionWest Harrison, NY Borrower well known to PBC sought construction financing for condominium units. The lot was owned free and clear and PBC provided the financing for the hard and soft construction costs.

Acquisition Bronx, NY

Acquisition Bronx, NY New borrower to PBC sought to acquire an investment property in the Bronx. PBC funded the transaction with a two-year mortgage.

Acquisition Island Park, NY

Acquisition Island Park, NY Repeat borrower acquiring another property in Island Park, New York. PBC provided 90% financing for the acquisition of this investment asset.

Acquisition Massapequa, New York

Acquisition Massapequa, New York Current PBC borrower acquired a SFR investment property, PBC funded 90% of the purchase price and closed within eight days.

C/O RefinanceFairview, New Jersey

C/O RefinanceFairview, New Jersey PBC funded a cash-out refinance on a two-year term for the longtime owner of a two-family investment property.

RefinanceIsland Park, New York

RefinanceIsland Park, New York Borrower required additional funds to complete a renovation of an investment SFR. PBC provided cash-out to settle back dated liabilities and the full budget required to complete the project.

Fix & FlipWhite Plains, New York

Fix & FlipWhite Plains, New York PBC financed 100% of the acquisition and rehabilitation of a single-family investment property.

Acquisition Garfield, New Jersey

Acquisition Garfield, New Jersey First time borrower introduced to PBC from a well known broker. PBC provided 75% of the acquisition of a three-family investment property.

Fix & FlipSouth Ozone Park, NY

Fix & FlipSouth Ozone Park, NY Repeat borrower purchasing a two-family property for a fix and flip. PBC financed 80% of the acquisition and 100% of the renovation.

RefinanceNew Rochelle, New York

RefinanceNew Rochelle, New York Commercial owner/operator sought quick cash-out refinance for a retail shopping center. PBC executed the loan in a quick fashion to satisfy the client’s needs.

RefinancePort Chester, NY

RefinancePort Chester, NY Borrower well known to PBC, needed to refinance their current loan due to the lender’s inability to refinance. PBC refinanced the loan within three weeks of being contacted.

RefinanceNorwich, CT

RefinanceNorwich, CT PBC provided a cash-out refinance on a mixed-use property consisting of two commercial and 10 residential units.

Fix & FlipWest Hempstead, NY

Fix & FlipWest Hempstead, NY PBC offered a first mortgage on an investment SFR fix/flip transaction. The investor sought an 90% acquisition and 100% rehabilitation loan, which PBC funded the entire request.

RefinanceIsland Park, NY

RefinanceIsland Park, NY PBC provided the refinance and rehab capital to a real estate investor repositioning SFR’s damaged by Sandy. The mortgage was collateralized by multiple properties.

Fix & FlipBelvidere, NJ

Fix & FlipBelvidere, NJ New borrower of PBC’s was acquiring a SFR for a fix and flip. PBC provided 90% of the acquisition and 55% of the rehab costs.

RefinancePutnam Valley, NY

RefinancePutnam Valley, NY Repeat borrower of PBC’s needed to refinance existing debt, which included an outstanding judgement, and PBC extended a one-year loan.

refinanceStamford, CT

refinanceStamford, CT Refinanced an investment condominium for a three-year term. Borrower needed to stabilize their current financial situation in order to obtain future permanent financing.

fix & flipBrooklyn, NY

fix & flipBrooklyn, NY New borrower to PBC sought a fix and flip loan on an investment property in the Carrol Gardens section of Brooklyn. PBC provided 80% of the acquisition and 50% of the rehabilitation capital. The investor intends to convert a single-family residence back into its original use, a two-family residence.

Fix & FlipSouth Ozone, NY

Fix & FlipSouth Ozone, NY Repeat borrower of PBC acquired a two-family residence. The purpose of the acquisition was to rehab the property and sell it upon completion (fix and flip). PBC lent 90% of the acquisition and rehab capital.

Fix & FlipHempstead, NY

Fix & FlipHempstead, NY Repeat borrower of PBC was purchasing a five property portfolio with the intention to fix and flip all of them. PBC funded the acquisition and the rehabilitation debt and met the Time of the Essence deadline.

Fix & FlipBronx, NY

Fix & FlipBronx, NY Repeat borrower of PBC acquired an investment SFR for a fix and flip opportunity from a loan servicer. PBC extended 90% LTV acquisition financing and the rehab budget. The borrower intends to market the property for sale upon the completion of the renovation.

Fix & FlipAtlanta, GA

Fix & FlipAtlanta, GA Longtime borrower known to PBC is acquiring a six-family property in Atlanta, Georgia for a fix/flip investment. PBC made the loan on the entire debt stack.

Fix & FlipCarmel, NY

Fix & FlipCarmel, NY PBC made a mortgage loan for a local contractor to acquire and rehabilitate (fix and flip) a single-family investment property in Carmel, New York.

Fix & FlipNewark, NJ

Fix & FlipNewark, NJ Borrower was acquiring a REO from the City of Newark and requested acquisition and rehabilitation funds for a fix and flip of the property. PBC provided the loan and assisted the borrower in navigating the bureaucratic issues that came along with this transaction.

Fix & FlipBrooklyn, NY

Fix & FlipBrooklyn, NY Repeat borrower of PBC sought refinance of a current loan held by PBC in order to raze and construct a new single-family home for an investment (fix and flip). PBC provided the initial funds to refinance the original loan and provided the construction loan for a two-year deal.

Fix & FlipWhite Plains, NY

Fix & FlipWhite Plains, NY PBC funded the entire capital stack for a fix and flip opportunity of a single-family residence. The borrower required debt and equity and is well known to PBC.

Fix & FlipMt. Sinai, NY

Fix & FlipMt. Sinai, NY PBC provided the capital for the acquisition and rehabilitation on an investment property for a repeat borrower.

RefinanceBrooklyn, NY

RefinanceBrooklyn, NY Pepe/Berard Capital provided the capital for a refinance and proceeds were used to pay past real estate taxes.

RefinanceHighland Falls, NY

RefinanceHighland Falls, NY Cash-Out refinance for a nine-family property, fully occupied, within close proximity to the campus of the USMA. Repeat borrower of PBC.

Fix & FlipAlbany, NY

Fix & FlipAlbany, NY An experienced real estate investor, but new borrower to PBC, requested the acquisition and renovation financing of a SFR in the Albany area. PBC funded the requested debt on the project and the borrowers are going to market the sale of the property upon completion of the project.

Fix & FlipWhite Plains, NY

Fix & FlipWhite Plains, NY Repeat borrower was seeking acquisition and rehabilitation financing for an investment SFR. PBC funded the entire capital stack and exit strategy is to sell the property upon completion of the rehabilitation.

Fix & FlipJamaica, NY

Fix & FlipJamaica, NY PBC was approached by a repeat borrower to fund the acquisition and expansion/conversion of a SFR into Two-Family residence. PBC funded the entire debt requirements and borrower will market the property for sale upon completion of work.

InvestmentStaten Island, NY

InvestmentStaten Island, NY PBC provided the capital for a cash-out refinance of a portfolio of six Single-Family Residences being held as an investment. A release provision has been provided in the mortgage to permit the borrower the flexibility to sell individual units.

InvestmentHighland Falls, NY

InvestmentHighland Falls, NY PBC funded a cash-out refinance and provided the rehabilitation financing for a single-family investment property. Borrower is an experienced investor and a longtime client of PBC.

RefinanceHuntington, NY

RefinanceHuntington, NY A new borrower to PBC, who is a contractor, was in the midst of renovating a SFR and sought a cash-out refinance and additional renovation funds for the completion of the project.

Fix & FlipStaten Island, NY

Fix & FlipStaten Island, NY Longtime borrower of PBC sought financing on a new fix and flip project on Staten Island. PBC provided 80% of the acquisition and 100% of the rehabilitation costs.

RefinanceJamesport, NY

RefinanceJamesport, NY PBC provided the refinance and rehabilitation capital for a mixed-use property. Borrower is converting the second floor into residential use as they continue to operate the ground floor as commercial space.

Fix & FlipTivoli, NY

Fix & FlipTivoli, NY PBC provided a repeat borrower with a cash-out refinance and rehabilitation funds for a fix and flip. The borrower acquired the asset, all cash, at a government auction.

Fix & FlipPhiladelphia, PA

Fix & FlipPhiladelphia, PA PBC financed a new fix & flip with a repeat borrower who is an experienced borrower.

InvestmentBrooklyn, NY

InvestmentBrooklyn, NY Full time investment group acquired a three-story brownstone and will perform a full, high-end, rehabilitation of the property. PBC finance the entire transaction within 10 days of receiving application.

RefinanceRye Brook, NY

RefinanceRye Brook, NY Refinanced a SFR for an investor within 14 days of application. Consolidated outstanding debts affixed to the property.

Fix & FlipOyster Bay, NY

Fix & FlipOyster Bay, NY PBC provided take-out financing to an estate to settle a foreclosure and to avoid bankruptcy. Property is to be renovated and sold.

AcquisitionBelleville, NJ

AcquisitionBelleville, NJ PBC financed the acquisition and rehabilitation loan for the acquisition of a three-family property. Borrower is a repeat borrower of PBC’s and an experienced real estate investor.

RefinanceBrooklyn, NY

RefinanceBrooklyn, NY Provided the capital for a refinance of a three-family residential property. First-time borrower of PBC.

RefinanceNew York, NY

RefinanceNew York, NY PBC provided the capital to a borrower for a refinance and additional funds to complete a full renovation of a condominium unit in the Chelsea section of Manhattan. PBC closed the deal within 14 days of receiving application.

Fix & FlipWallkill, NY

Fix & FlipWallkill, NY Repeat borrower of PBC required rehabilitation financing for a single-family investment property (fix/flip). PBC funded the rehab with flexible terms.

RefinanceHopewell Junction, NY

RefinanceHopewell Junction, NY PBC provided a cash-out refinance for a recently renovated singe-family residence. The property is an investment and will be offered for sale within a month of closing. Borrower is a longtime borrower with PBC and an experienced investor.

RefinanceBranford, CT

RefinanceBranford, CT PBC closed a cash-out refinance within two weeks of receiving file. Borrower needed funds to purchase a new property in Florida. Exit strategy is to sell the CT property.

RefinanceBrooklyn, NY

RefinanceBrooklyn, NY Provided a cash-out refinance to a repeat borrower. Proceeds are being used for another purchase which PBC will be the lender on that transaction.

ConstructionTarrytown, NY

ConstructionTarrytown, NY Provided the construction financing of a new single-family residence to a local developer known to PBC.

Fix & FlipStaten Island, NY

Fix & FlipStaten Island, NY PBC provided the capital for the short-sale of a single-family residence. The borrower is an experienced investor and repeat borrower of PBC. The exit strategy is to rehabilitate the property and an eventual sale (fix and flip). PBC extended the acquisition and rehabilitation financing.